Solutions

Founded in 2011, Kidbrooke is a tech company providing APIs for building next-generation wealth management services. We bring together expertise in financial modelling, data science and software development to help create solutions that deliver the best outcomes for financial institutions and their customers alike. We believe the future is a world where everyone can make informed financial decisions.

Our Solutions address key challenges within the modern financial industry

Quality and Transparency of Financial Decisions

We use technology to enable you to provide personalised, high-quality and transparent financial decision support to your customers. Our APIs enable banks and insurers to meet the customer in their channel of choice, increase the number of recurring touchpoints and considerably improve engagement levels.

Automate to Achieve Cost Efficiency

Intelligent automation allows you to reduce production costs for financial decisions and decision-support by up to five times. The OutRank API equips you with tools to automate a significant share of the work required to help your customers make educated financial decisions. This allows the human staff to concentrate on building and nurturing customer relationships.

Unlock Underserved Customer Segments

Reducing production costs allow you to tap into previously underserved market segments, and to increase the availability of high-quality financial decision-tools to a larger share of the population.

Holistic Financial Planning

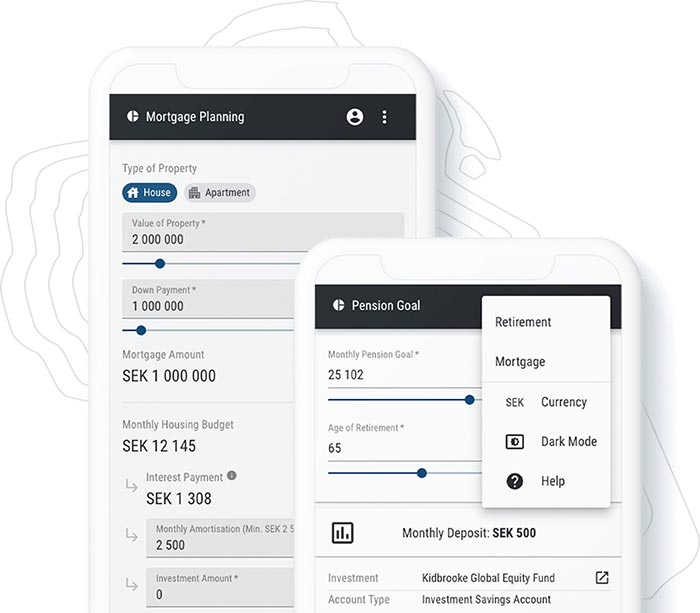

Kidbrooke's OutRank is a collection of APIs powering seamless financial decision-making based on the simulations of the personal balance sheets of your customers. The holistic customer journey supports a 360-degree view, enabling them to make educated choices in managing their short-term savings, retirement planning and mortgages.

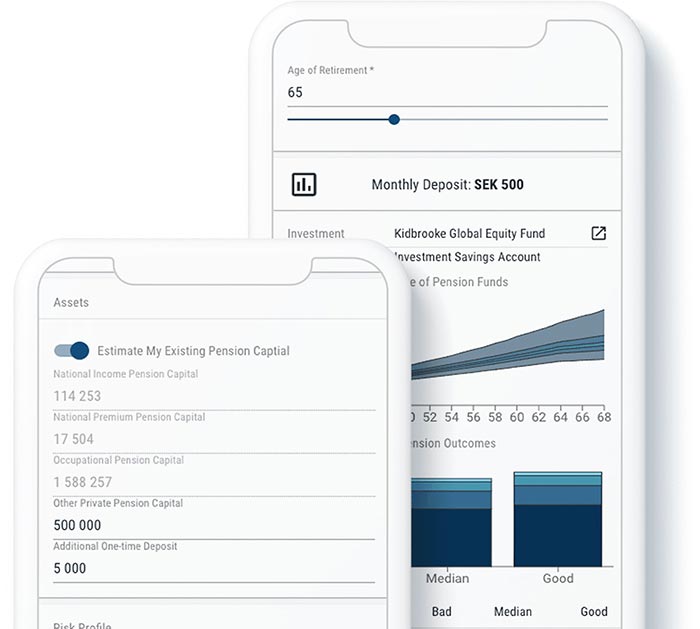

Pension Planning

Kidbrooke’s OutRank includes is an API which enables pensions providers to build the next generation of pension journeys for Accumulators as well as Decumulators. OutRank helps your customers to navigate through the intricacies of retirement planning by delivering seamless financial decision-making tools. Our APIs are designed by experienced domain experts, ensuring that the underlying models will help you really add values to your customers.

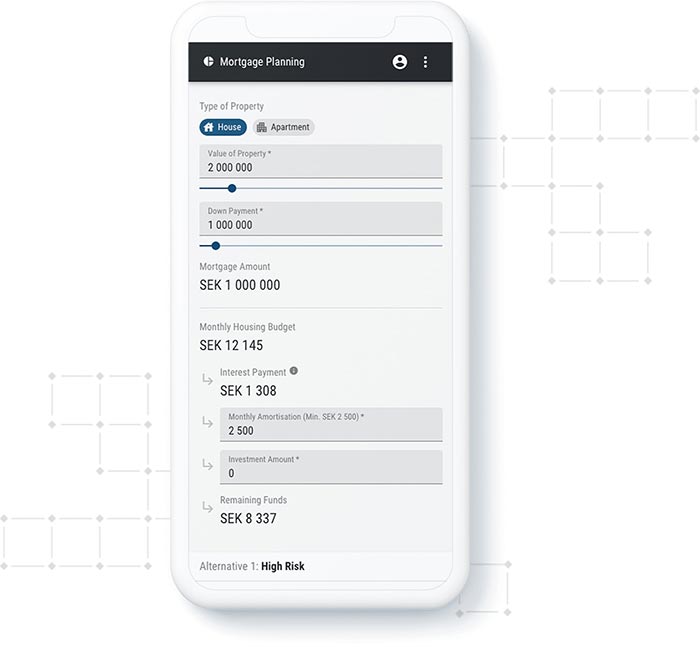

Credit and Mortgage Analytics

Kidbrooke's OutRank provides easy-to-use, high-quality analytics guiding your customers through the complexities of taking out mortgages and other loans. Our collection of APIs helps banks, insurers and FinTechs to build reliable digital journeys enabling individual consumers to evaluate credit decisions in a uniquely holistic context. A 360-degree view powered by OutRank encourages your customers to make more informed financial choices, backed by our research-based technology.

Short-to-Medium Term Savings

Kidbrooke's Short-to-Medium term savings API powers digital investment journeys within financial institutions. Our simulation-based approach powers innovative and insightful investment experiences, helping wealth businesses to better guide their customers towards their financial goals.